- Enterprise Suite

-

QuickBooks Enterprise

OverviewFeaturesPlans & PricingIndustry Solutions

- QuickBooks Online

-

Resource

About Us

- Contact Us

Not sure which QuickBooks Solution is Right for You? Call 231-670-4156 Get A Free Consultation

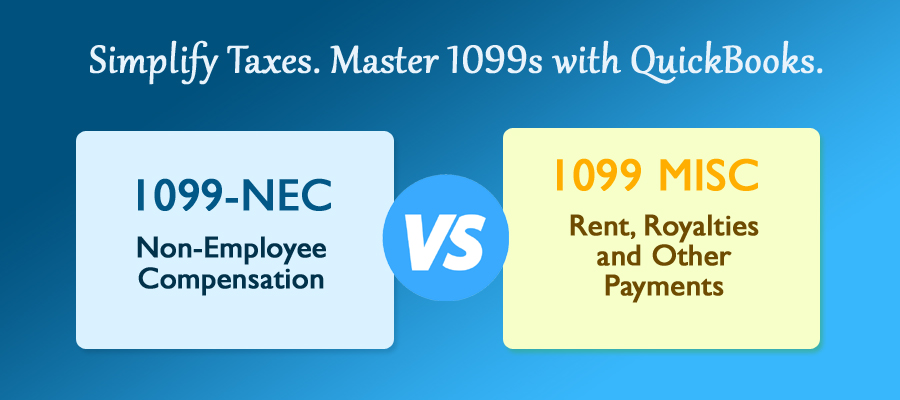

If you're running a small business in the U.S., you've probably encountered 1099 forms during tax season. These forms are essential for reporting payments made to individuals and companies who aren’t your employees. However, due to the multiple versions available, one common question arises: when should you use 1099-NEC versus 1099-MISC?

Understanding the difference between 1099-NEC and 1099-MISC is crucial to complying with IRS regulations and avoiding costly filing errors. Whether you are paying independent contractors, rent, or other miscellaneous income, it is important to select the correct form.

In this QuickBooks-friendly guide, we'll explain what 1099-NEC and 1099-MISC are, highlight the key differences, and show you how QuickBooks can make the filing process faster, easier, and error-free—so you can focus more on running your business and less on paperwork.

Before getting into the details, it is important to understand the basic definitions and purposes of these two commonly used tax forms.

Form 1099-NEC stands for Nonemployee Compensation. This is specifically used to report payments made to individuals or businesses who are not employees but have provided services for your company. This typically includes freelancers, independent contractors, consultants, and gig workers. If you hired someone to design your website, repair office equipment, or provide professional services, and paid them $600 or more during the tax year, you’ll most likely need to issue them a 1099-NEC. These individuals don’t receive a W-2 because they aren’t on your payroll, but their earnings still need to be reported to the IRS.

In contrast, Form 1099-MISC is prepared to report miscellaneous income that is not classified as non-employee compensation. This includes payments such as rent, royalties, awards, legal settlements, and medical or healthcare benefits. For example, if your business pays a landlord $1,000 in office rent or issues a cash prize for a promotional contest, those payments would be reported on a 1099-MISC

In summary, the difference between 1099-NEC vs. 1099-MISC lies in the payment. If you're paying for a service provided by someone not your employee, 1099-NEC is generally the form you'll need. For other types of business-related payments that aren't tied to services, 1099-MISC is the correct choice.

| Type of Payment | Use Form 1099-NEC | Use Form 1099-MISC |

|---|---|---|

| Independent Contractor Payments | Yes - Use 1099-NEC for services performed by non-employees (e.g., freelancers, consultants) if $600+ paid | No - Contractor services should not be reported on 1099-MISC |

| Professional Service Fees | Yes - Includes payments to attorneys, accountants, or IT professionals | No - Except if attorney payments are for legal settlements (see MISC section) |

| Rent Payments (Commercial or Office) | No | Yes - Use 1099-MISC to report business-related rent payments |

| Royalties | No | Yes - Report royalty payments of $10 or more |

| Prizes and Awards | No | Yes - Cash or non-cash awards not for services rendered should be reported on 1099-MISC |

| Medical and Healthcare Payments | No | Yes - Payments to medical providers (e.g., doctors, clinics) |

| Attorney Legal Settlements | No | Yes - Use 1099-MISC for gross proceeds paid to attorneys in legal settlements |

| Reimbursements (non-service) | No | Yes - If not tied to services rendered and meet IRS criteria |

| Director's Fees | Yes - Considered nonemployee compensation | No |

| Commissions (non-employee) | Yes - If paid to a non-employee or independent sales rep | No |

| Fishing Boat Proceeds | No | Yes - This unique category is still reported on 1099-MISC |

| Nonqualified Deferred Compensation | Yes - If currently includable in income | No |

| Gross Proceeds to Attorneys | No | Yes - If not for legal services, but for settlements or other payments received |

Quick Tip: Legal services may be reported on 1099-NEC if they involve direct compensation. Always double-check with your accountant or QuickBooks advisor.

You may ask yourself, "Does it matter which form I use—1099-NEC or 1099-MISC?" The short answer is: yes, it does.

Using the wrong form isn’t just a simple oversight—it can lead to processing delays, inaccurate tax records, IRS penalties, and compliance issues. For example, if you mistakenly report contractor payments on a 1099-MISC instead of a 1099-NEC, the IRS may flag your return for errors or non-compliance. This can result in follow-up inquiries, fines, and time-consuming corrections that could have been avoided.

To reduce this confusion and improve reporting accuracy, the IRS reintroduced Form 1099-NEC in 2020, separating non-employee compensation from other miscellaneous income previously grouped on Form 1099-MISC. This change helps businesses report contractor payments more clearly and streamlines tax reporting for both payers and recipients.

That’s why it’s so important to understand the difference between 1099-NEC and 1099-MISC. Knowing which one to use based on the payment's type ensures that your business remains compliant, avoids unnecessary penalties, and stays organized when tax season arrives.

One of the biggest challenges for small business owners is ensuring they’re using the correct tax forms—and filing them accurately and on time. That’s where QuickBooks comes in.

With QuickBooks, you don’t have to second-guess whether to use 1099-NEC or 1099-MISC. The platform is designed to simplify your 1099 process from start to finish. Here’s how it helps:

Track payments to contractors and vendors:

QuickBooks automatically keeps records of all payments made to non-employees throughout the year, categorizing them based on the type of service or transaction.

Automatically determine the right form:

Depending on how you categorize your expenses and vendor types, QuickBooks will indicate whether the payment qualifies for a 1099-NEC or a 1099-MISC, helping you avoid confusion and mistakes.

Seamless e-filing:

When it’s time to file, QuickBooks allows you to electronically file your 1099 forms directly with the IRS and even sends copies to your contractors via email or mail, saving you time and effort.

Built-in accuracy checks:

QuickBooks performs automated reviews before filing to catch missing information or inconsistencies, significantly reducing the risk of errors and IRS penalties.

By automating and simplifying the entire 1099 workflow, QuickBooks ensures you stay compliant and allows you to focus on what matters most – growing your business and serving your customers.

In short, the difference between 1099-NEC and 1099-MISC is the kind of payment reporting. If paying independent contractors or freelancers for services rendered, typically use Form 1099-NEC. On the other hand, if reporting miscellaneous types of income, such as rent, royalties, or legal settlements, you likely need to use Form 1099-MISC.

Understanding when to use 1099-NEC vs. 1099-MISC is more than just good bookkeeping—it's a critical part of maintaining IRS compliance, avoiding late filing penalties, and ensuring your business records are accurate and audit-ready.

If sorting out your 1099s feels overwhelming, you're not alone. At Minding My Books, we specialize in providing expert QuickBooks support tailored to small businesses across the U.S. From categorizing expenses correctly to e-filing the right forms, we’ll make sure your 1099 process is smooth, accurate, and hassle-free.

Reach out today to discover how we can help you stay compliant, organized, and ready for whatever tax season brings.