Connect Avalara with QuickBooks To Simplify Tax Compliance

Boost Efficiency and Accuracy by Automating Sales Tax

Avalara AvaTax is a smart sales tax integration for QuickBooks, perfect for growing businesses. It automates tax calculations, reporting, and filing to save time and improve accuracy. Minding My Books offers expert support for Avalara integration with QuickBooks.

What is Avalara?

Avalara is a prominent tax compliance software company founded in 2004. It provides cloud-based solutions for managing sales tax, VAT, excise tax, and other transactional taxes. With a comprehensive platform, Avalara caters to businesses of all sizes to ensure compliance with various jurisdictions.

Key Benefits

Accurate tax calculations with up-to-date rates and rules.

Save time by automating tax filing and remittance.

Scalable tax compliance that grows with your business.

Category:

Sales and Use Tax

QuickBooks Compatibility:

QuickBooks Enterprise

QuickBooks Online

How Does Avalara Work?

Avalara AvaTax integrates seamlessly with your accounting system to automate and streamline complex tax processes. Here’s how it ensures accuracy and compliance:

Precise Geolocation & Address Validation: Calculates tax based on verified addresses, ensuring jurisdiction-level accuracy.

Accurate Product Taxability Mapping: Applies the correct tax rates by matching products and services to the right tax codes.

Real-Time Tax Rate Updates: Automatically updates rates and rules as tax laws change—no manual updates needed.

Exemption Certificate Management: Tracks, stores, and applies exemption certificates for qualifying customers with ease.

End-to-End Tax Automation: From calculation to filing, Avalara automates the entire sales tax process, reducing risk and saving time.

By automating these processes, Avalara reduces manual errors and ensures compliance with tax regulations.

Advanced Capabilities of Avalara AvaTax

Avalara AvaTax offers advanced capabilities like international tax compliance, cross-channel support, and detailed reporting. Its delivers advanced automation, accuracy, and flexibility for managing sales tax. Its intelligent tools help streamline compliance, minimize audit risk, and scale with your growing business needs.

Product Taxability Codes

Avalara maintains predefined tax codes that track taxability for software and related services categories, regardless of the delivery methods, in all U.S. states. Assigning items to tax codes enables product- and item-level taxability across all channels and ordering technologies from the vendor.

Centralized Tax Policy Administration

AvaTax provides centralized administration to implement tax policies across the business to calculate sales and use tax across all channels more accurately.

Custom Tax Rules

AvaTax empowers users to craft personalized tax rules tailored to items with specific tax codes, enabling them to override the standard Avalara tax categories. This flexibility ensures that your tax strategies are as unique as your business needs.

Advanced Transaction Rules

AvaTax enables businesses to create, modify, and apply specific rules related to business and taxability, which are executed before the tax calculation.

AP Assessment & Accrual

All accounts payable (AP) transactions, regardless of their source and processing status, will be displayed in an enhanced transaction list within AvaTax. This feature will also allow users to review variances for over- and undercharged transactions and take action on one, several, or many transactions.

Unified AP Config

All configurations will be centralized in the Accounts Payable solution within AvaTax, which applies to real-time and batch transactions with a hybrid design.

Sourcing Rules

Sales tax treatment varies by state depending on sourcing rules, which determine whether sales taxes are based on the seller's location or the buyer's destination. AvaTax addresses this variation by automatically applying the sourcing rules based on the seller's address and the shipping location provided by the buyer.

Out-of-the-box Integrations

Avalara's standard integrations with ERP, order management, CRM, procurement, and e-commerce technologies establish AvaTax as a unified platform for consistently and accurately applying sales and use tax rates and product taxability rules. This ensures uniformity throughout the quoting, order creation, and invoicing processes.

Rest API Access

The AvaTax REST API provides key capabilities for engaging with the AvaTax service, allowing users to compute taxes, edit documents, and verify addresses. This functionality facilitates the smooth integration of business applications with online ordering systems, ensuring customers enjoy a seamless purchasing experience.

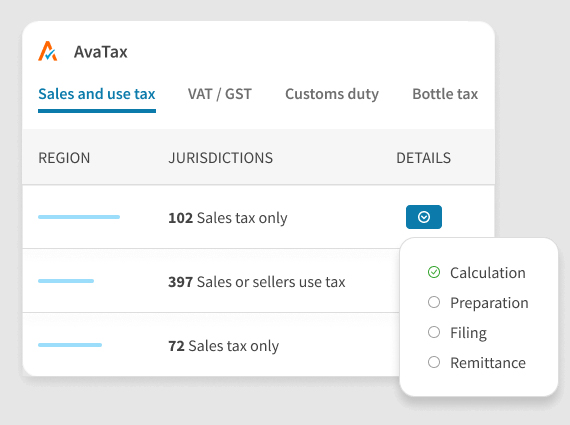

Jurisdictional Nexus

Avalara provides predefined jurisdictions, including U.S. states, local jurisdictions, and non-U.S. countries. This feature allows users to easily adjust their tax profiles as their businesses grow and expand. Users can modify these tax profiles to specify where and when AvaTax calculates and reports various taxes, such as sales tax, use tax, input VAT, and output VAT, for their companies.

Geospatial Technology

AvaTax employs advanced proprietary geospatial technology to meticulously validate addresses, ensuring they are accurately mapped to a comprehensive national database of tax jurisdictions. This technology analyzes various geographical data points, enabling precise matching between specific locations and the applicable tax regions. By doing so, AvaTax assists businesses in ensuring compliance with local tax regulations and simplifies the process of tax calculations based on the most accurate data available.

Comprehensive Reporting

Avalara offers a comprehensive library of transaction tax reports that summarize and present your transactional history. These reports are designed to assist you in reconciling transactions in AvaTax with your accounting, ERP, ecommerce, m-commerce, or POS applications. They also help with preparing tax returns and forms and reviewing tax liabilities. Our comprehensive reporting provides jurisdictional reports that include detailed line-level information.

Avalara vs Competitors: Side-by-Side Comparison

| Feature / Platform | Avalara | TaxJar | Vertex | Sovos | TaxCloud |

|---|---|---|---|---|---|

| Best For | Medium-Large Businesses | eCommerce SMBs | Large Enterprises | Multi-national Corporations | Budget Startups / SST States |

| Pricing Model | Tiered + Per Return | Subscription | Custom Quote | Custom Quote | Free or Low-Cost |

| Starting Price | ~$50-$100/month | $19-$99/month | Custom | Custom | Free-$10/month |

| Automated Filing | Yes | Yes | Yes | Yes | Yes |

| Marketplace Integration | Extensive | Shopify, Amazon | Limited | Limited | WooCommerce, API |

| International Tax Support | Yes | US-Only | Yes | Yes | US-Only |

| Nexus Tracking | Advanced | Basic | Advanced | Advanced | Basic |

| Cert Management (Exemptions) | CertCapture | Add-on via TaxJar Pro | Yes | Yes | Manual |

| Real-Time Tax Rates | Fast + Accurate | API | Yes | Yes | Yes |

| Customer Support | Paid Tiers | Email + Chat | Enterprise SLA | SLA-Based | Basic |

Key Features of Avalara QuickBooks Integration

Avalara’s sales tax integration for QuickBooks lets you calculate rates, prepare returns, manage exemption certificates, and more—all directly within your accounting software.

Accurate Tax Calculations

Avalara calculates sales tax for various transaction types, including:

Invoices

Sales Receipts

Credit Memos

Quotes

Sales Orders

It uses either the bill-to or ship-to address for tax determination, ensuring flexibility and accuracy.

Address Validation

Utilizing the USPS database, Avalara verifies and corrects addresses, enhancing delivery accuracy and tax rate precision.

Error Resolution

Identify and fix sales tax errors within QuickBooks, ensuring all transactions are accurately processed and compliant.

Exemption Management

Manage tax-exempt customers by Avalara

Assigning exemption numbers

Using entity/use codes

Integrating with CertCapture for certificate management

Reporting and Reconciliation

Generate comprehensive reports, such as:

Tax History Details

Item Tax Code Mapping

Customer Tax Items

Configuration Summaries

These reports can be exported in formats like PDF, XLS, DOC, and RTF.

Product Taxability Customization

Map items using item codes or UPCs to specific tax codes, allowing for precise tax application on diverse products.

Industries That Benefit Most from Avalara QuickBooks Integration

Avalara AvaTax is designed to support a wide range of industries that deal with complex, multi-jurisdictional tax requirements. When integrated with QuickBooks, it helps streamline tax compliance and minimize risk for businesses operating across states or countries. Below are some industries that see the greatest impact.

eCommerce & Online Retail

Automatically apply correct tax rates for orders across multiple states or countries with real-time updates for online sellers.

Manufacturing & Distribution

Manage taxability of raw materials and equipment, while automating exemption certificate handling across sales channels.

Software & Digital Products

Ensure compliance for SaaS and digital goods by applying accurate tax codes and staying updated with jurisdictional rules.

Professional Services

Streamline tax rules for services and manage exempt clients with ease using Avalara’s integration in your QuickBooks workflow.

Wholesale & B2B Sales

Automate wholesale tax logic, apply customer exemptions, and ensure accurate invoicing with QuickBooks and Avalara.

Food & Beverage

Handle tax rules for food products, prepared meals, and beverages while managing multi-location tax reporting seamlessly.

Avalara Pricing

Avalara has scalable products and services that fit your business. Whether you're looking for help with returns only or a full integration with QuickBooks Online and your ecommerce platform, we can provide you with the right solution.

Pricing Plan: Custom - Avalara Compliance Cloud Suite

Users: N/A

Price: Custom Quote

Frequently Asked Questions

What is Avalara, How is different from other tax calculation systems?

Avalara is a cloud-based tax automation platform that simplifies the complex world of transaction taxes. It automatically calculates sales tax, use tax, VAT, and other indirect taxes in real-time across jurisdictions. Avalara stays updated with 13,000+ U.S. sales tax jurisdictions and global tax rules, so businesses can avoid compliance risks, reduce audit exposure, and confidently scale into new markets. Avalara also has solutions to prepare and file your returns, as well as easily manage exemption certificates in the cloud, all of which are tightly integrated with AvaTax.

Does Avalara handle tax returns and filing too?

Yes. Avalara not only calculates taxes but also automates filing and remittance. Through its AvaTax Returns service, Avalara prepares, files, and pays sales and use taxes to the appropriate authorities on your behalf. It helps eliminate manual errors, saves hours of paperwork, and ensures on-time compliance with varying tax deadlines across states and countries.

Does Avalara provide support?

Yes, you’ll have unlimited access to the Avalara Help Center 24 hours a day, seven days a week. More advanced support packages are also available to purchase.

I have multiple companies. Will AvaTax work for me?

Yes, AvaTax will manage your tax compliance across multiple companies, even across complex corporate structures (parent/child companies, etc.)

Which QuickBooks versions support integration with Avalara AvaTax?

Avalara AvaTax integrates seamlessly with the following QuickBooks versions:

QuickBooks Desktop

QuickBooks Enterprise

QuickBooks Online

QuickBooks Online Advanced

This ensures businesses of all sizes can automate tax calculations, manage compliance, and simplify filing directly from their preferred QuickBooks platform.

How does Avalara integrate with QuickBooks, and what are the benefits?

Avalara connects seamlessly with both QuickBooks Desktop and QuickBooks Online through certified integrations. Once connected, it automatically applies accurate sales tax rates during invoicing, syncs with product/service tax codes, and supports exemption certificate management—all from within your QuickBooks dashboard. This real-time automation reduces errors, saves time, and simplifies compliance for busy finance teams.

Can I use Avalara with QuickBooks for multi-state or multi-location tax compliance?

Absolutely. Avalara is designed to handle complex tax scenarios, including multi-state sales, destination-based sourcing, and taxability variations by product or service. When used with QuickBooks, it ensures that every transaction, no matter the state or local jurisdiction, is taxed accurately based on the customer’s shipping address and your nexus obligations.

Schedule a Personalized Demo with Minding My Books

Are you overwhelmed by the complexities of managing sales tax, filing returns, or staying compliant across multiple jurisdictions? Let us help you simplify the process.

Minding My Books works closely with you to tailor tax automation solutions using Avalara, one of the leading platforms in the industry. We’ll show you how Avalara can save time, reduce errors, and keep your business compliant, without the headache.

Why Schedule with Minding My Books?

Unlike software vendors who sell subscriptions, we offer expert, unbiased guidance tailored to your accounting workflows. As certified Avalara partners and QuickBooks specialists, we don’t just implement tools—we help you understand and use them effectively.Contact us today to schedule a FREE consultation and take the first step toward hassle-free tax compliance.